13 June 15

We act for companies looking to raise finance or equity capital and we often get asked "Will investors invest in my company?" and "Do you have any investors?". From extensive experience, while the question may be quite simple the answer can be a little more complicated.

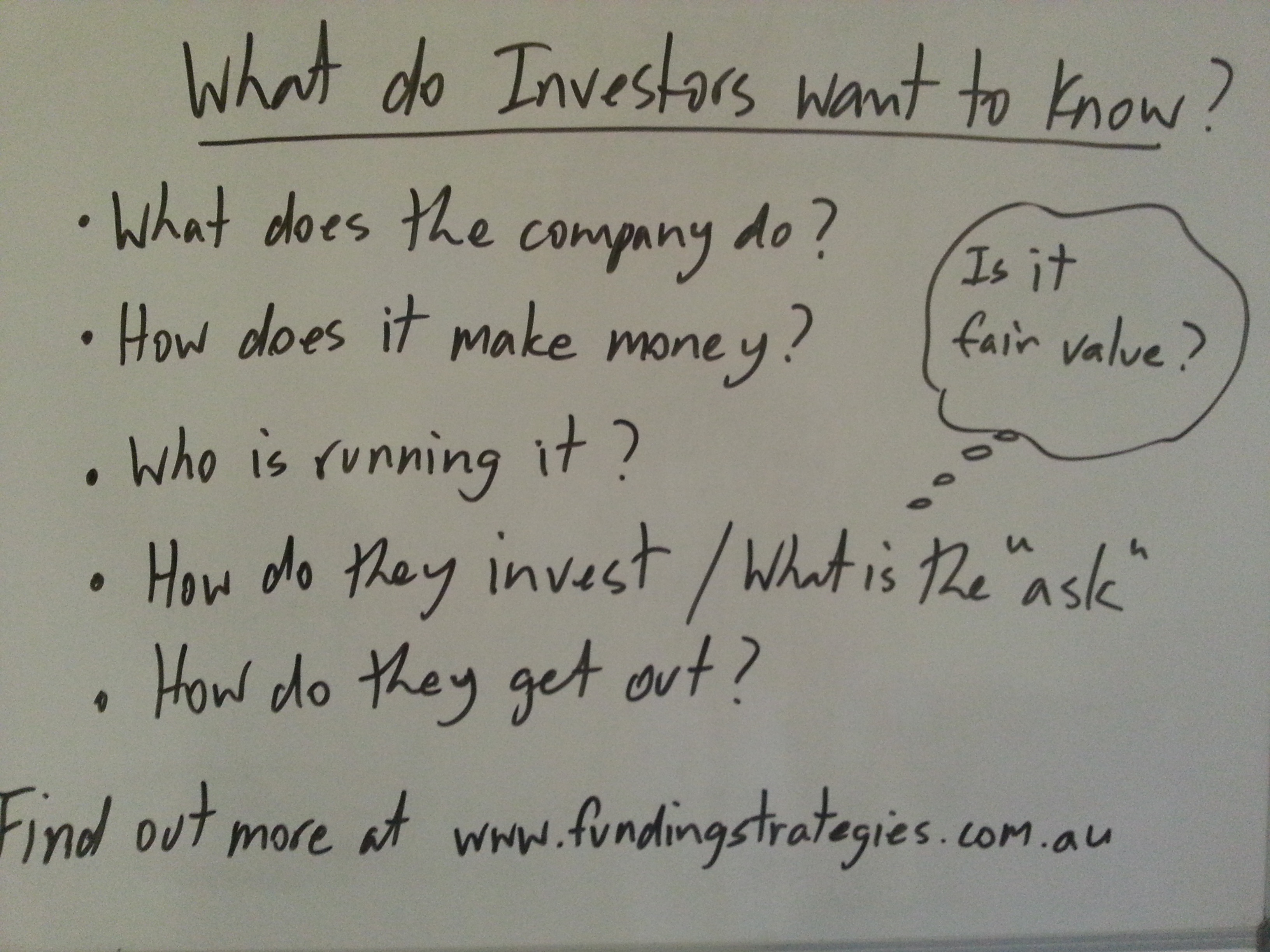

Investors will invest in private companies but companies need to satisfy a number of key investor queries first:

The company needs to be "well packaged" so the investor understands the value proposition, strategy and the business model of the company. Without this understanding many potential investors will not invest. For example the company should have an excellent information memorandum or investor precis supported by a "data room" of relevant company and investor information. Comprehensive financials including current P&L, Balance Sheet and Forecast are a must. We quite often move our clients to a "Limited Company" raising the level of governance and transparency of the company to assist with investor confidence in the company ie. they must have audited accounts and a credible Board of Directors. If these sorts of steps are not taken it can be quite "a hit and miss" proposition around attracting investors. There also must be a pathway to an "exit" for these investors whether it be a trade sale or stock exchange listing.

The investor needs to be "engaged" by the company so that they can follow the matter. Giving the prospective investor regular updates on the progress of the company and a chance to meet with the company helps build trust and decrease completion risk around the investment. The photo above was taken at a recent breakfast networking event where investors had the opportunity to meet with various company executives.

On the question on "Do you have any investors" we have lots of potential investors! The issue is will they invest in this particular company as it is presented and at it's current stage of development. The biggest concern investor's raise is the valuation, and the company's ability to execute the strategy and business plan ie. to hit the forecast numbers and milestones. Different types of investors might be approached at different stages in the company's life-cycle and capital raising activities. For example investors that are somehow connected to the company are more likely to invest earlier in the capital raising life-cycle.

One of the issues we find with some companies is they "second guess" who might be an investor. Again in our experience almost anyone can be an investor if the company is presented properly and they have a good management and Board. Folk that are passionate about the company and it's prospects will often invest.

Investors come in "all shapes and sizes" - retail, sophisticated, overseas, family offices, venture capital, private equity, funds, high net wealth individuals, companies ..... The issue is engaging with them and allowing them to "follow your company" and to build trust and engagement so they invest when they are ready. Sometimes there is a mismatch in timing between what the company expects from an investor and what the prospective investor's time frames are so it is important to have a "funding strategy" to maximise the investor opportunities.

Raising capital is difficult, but if you follow our proven process based on our experience and many successful raises, you are more likely to succeed.

Funding Strategies raises finance and equity capital for profitable companies looking for expansion capital. Contact us at brisbane@fundingstrategies.com.au.

If you are an investor looking for opportunities you can log on and see our private opportunities here.